CRA Penalties You Should be Aware of in 2025

When it comes to taxes, everyone wants to play by the rules and stay on the right side of the law. However, the rules can be overwhelming, and with numerous deadlines and compliance requirements, it’s easy to miss something. That’s why we’re here to break it all down for you. In this post, we’ll cover the various CRA penalties, interest charges, and other compliance issues that individuals and businesses need to be aware of in 2025. Whether you’re managing your personal taxes or handling business finances, understanding these potential pitfalls will ensure you stay in good standing with the CRA.

Late Filing CRA Penalties for Personal Income Tax

When it comes to filing your taxes, staying on top of key deadlines is crucial. These are the dates you should mark in your calendar and plan your tax-related activities around to avoid penalties:

- March 3, 2025: Deadline to contribute to an RRSP, PRPP, or SPP.

- April 30, 2025: Deadline to file your taxes.

- June 15, 2025: Deadline to file your taxes if you or your spouse/common-law partner are self-employed.

Missing any of these deadlines could result in penalties, which can quickly add up. As of now, the CRA website hasn’t updated the penalty rates for late filing of 2024 taxes, but here’s what we know based on 2023’s penalties:

- Late Filing Penalty: The penalty for filing late is 5% of the balance owing for 2023, plus an additional 1% for each month your return is late, up to a maximum of 12 months.

- Higher Penalties for Prior Years: If you received a formal demand for return from the CRA for tax years 2020, 2021, or 2022, the penalty is more severe. For 2023, the penalty starts at 10% of the balance owing and increases by 2% for each full month the return is late, up to a maximum of 20 months.

Additionally, any unpaid balance from these years, if not settled by April 30, 2024, will begin accruing compounded daily interest starting May 1, 2024.

For individuals who are required to pay tax installments, missing those payments also results in interest charges. If the total installment interest charges for 2024 exceed $1,000, an additional penalty is applied. This penalty is calculated by subtracting from the installment interest either:

- The greater of $1,000 or

- 25% of the calculated installment interest if no payments were made for the year.

If you find yourself facing these penalties or interest charges, don’t panic. You can request to have them canceled or waived, but you’ll need to demonstrate that circumstances beyond your control (like illness or a natural disaster) prevented you from meeting your tax obligations.

Late Filing of Information Returns Slips

If you’re a business or individual who files more than five information return slips, it’s essential to file them electronically through the CRA’s internet file transfer or web forms. These methods help streamline the process and ensure your filings are done on time. You can access more information on these filing options here:

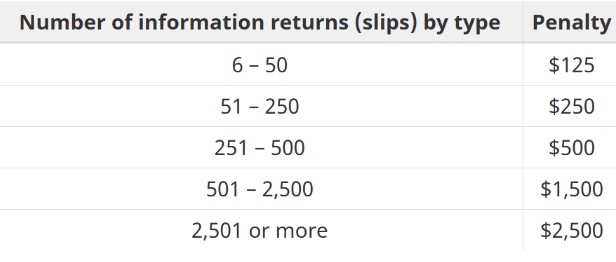

Failure to file information returns using these methods can result in penalties. The penalties are applied based on the number of returns you fail to submit electronically, as follows:

For example, if a business issues 6 T4As and 8 T5s via paper mail instead of electronically, they will face two separate penalties of $125 each—one for the T4As and one for the T5s.

It’s important to be mindful of these penalties, as they can quickly add up. Planning ahead and using the correct filing methods will save you both time and money. If you’re unsure about the process, there are plenty of resources available on the CRA website to guide you through electronic filing.

Failure to Provide Social Insurance Number on an Information Return

When issuing an information return for an individual, it’s essential to include their Social Insurance Number (SIN) and name on the return slips. The person preparing the return must make a reasonable effort to obtain this information. If they fail to do so, a penalty of $100 may be applied for each instance where the SIN is missing.

In general, the deadline to file information returns is the last day of February following the calendar year to which the return pertains. However, if you’re unable to obtain the SIN for an individual, the information return must still be filed on time—even without the SIN. Failing to file on time, or not making a reasonable effort to obtain the SIN, could result in penalties.

It’s important to be proactive in obtaining the necessary information to avoid these penalties. If you’re facing challenges gathering this information, make sure you document your efforts to show that you took the necessary steps to comply.

Penalty for Repeated Failure to Report Income

If you fail to report an amount of $500 or more on your tax return, you may face both federal and provincial or territorial penalties. This applies to your 2023 tax return, as well as for the 2020, 2021, or 2022 tax returns.

The penalty will be whichever is less:

- 10% of the amount you failed to report (for both federal and provincial/territorial taxes)

- 50% of the difference between:

- The understated tax or overstated credits for the amount you failed to report

- The tax that was withheld from the amount you failed to report

It’s important to note that if you voluntarily disclose any income you failed to report or credits you overstated (or both) before the CRA contacts you, you may qualify for penalty relief. This means that coming forward on your own can help reduce or eliminate penalties, and the CRA will typically be more lenient in these cases.

Being proactive about reporting all income and ensuring accurate credits will help you avoid these costly penalties and keep your tax filings in good standing.

False Statements or Omissions Penalty

If you knowingly, or through gross negligence, make a false statement or omission on your 2023 tax return, you may be subject to a penalty. The penalty will be whichever is greater:

- $100

- 50% of the understated tax or overstated credits (or both) related to the false statement or omission

The CRA may offer penalty relief if you voluntarily disclose any amounts you failed to report or credits you overstated (or both) before the CRA contacts you, or anyone related to you. Voluntary disclosure can help reduce or eliminate the penalty and show good faith on your part.

It’s crucial to carefully review your tax return for accuracy to avoid such penalties. If you realize an error after filing, coming forward voluntarily can save you from heavier consequences down the road.

Request to Cancel or Waive Penalties or Interest

If you’re unable to meet your tax obligations due to circumstances beyond your control, you have the option to request that the CRA cancel or waive penalties or interest. Common reasons for such requests might include serious illness, natural disasters, or other unforeseen events that prevented you from filing or paying on time.

It’s important to note that the CRA can only grant relief within 10 years from the date of your request. If you believe you qualify for this relief, it’s best to act as soon as possible to avoid additional penalties or interest from accruing.

Being proactive in addressing your situation and providing adequate documentation to support your request will increase your chances of having the penalties or interest waived.

Corporations Not Reporting Income

Failure to File CRA Penalties

Corporations that fail to file their tax returns on time face penalties based on the amount of unpaid tax due on the filing deadline. The general penalty is:

- 5% of the unpaid tax due on the filing deadline, plus

- 1% of this unpaid tax for each complete month the return is late, up to a maximum of 12 months.

However, corporations that are subject to a demand to file under subsection 150(2) of the Income Tax Act and have previously been assessed a failure-to-file penalty in any of the past three tax years face even harsher penalties. In these cases, the penalty is:

- 10% of the unpaid tax when the return was due, plus

- 2% of this unpaid tax for each complete month the return is late, up to a maximum of 20 months.

These penalties can add up quickly, so it’s crucial for corporations to file their returns on time and ensure all income is accurately reported to avoid unnecessary fines. If you’re facing challenges, it’s best to seek guidance or make arrangements with the CRA before penalties increase further.

Instalment Penalty

If the instalment interest exceeds $1,000, the CRA may apply an instalment penalty under section 163.1 of the Income Tax Act.

The penalty is calculated by subtracting from the instalment interest the greater of the following:

- $1,000, or

- 25% of the instalment interest calculated as though no instalment payment had been made for the year.

Once the greater of these two amounts is determined, one-half of the difference will be the amount of the penalty.

To help clarify, the CRA provides examples of how to calculate instalment interest and penalties. It’s important to carefully review your instalment payments to avoid these additional charges.

Large Corporation Filing Requirements and CRA Penalties

Large corporations are required to file the following:

- T2 Corporation Income Tax Return

- Schedule 38, Part VI Tax on Capital of Financial Institutions, if applicable

Failure to file these returns on time, in addition to any other applicable penalties, will result in a penalty for each complete month the returns are late, up to a maximum of 40 months. The penalty is calculated by adding the following components:

- 0.0005% of the corporation’s taxable capital employed in Canada at the end of the tax year

- 0.25% of the Part VI tax payable by the corporation (before the deductions in subsection 190.1(3))

These penalties can add up significantly, so it’s crucial for large corporations to file all required returns on time to avoid these costly charges. It’s always advisable to stay ahead of filing deadlines to ensure full compliance and minimize any penalties.

Conclusion

We’ve just scratched the surface of what penalties can look like, but believe us, you don’t want to find yourself facing these issues—whether it’s for your personal taxes or your business. It’s always better to take a proactive approach through proper financial planning. By aiming for success with adequate preparation and due diligence, you can not only avoid these penalties but also open the door to potential credits and incentives from the CRA—all while staying fully compliant.

That’s the kind of position you want to be in—confident in your financial standing and ready to make the most of the opportunities available to you. So, make sure you’re staying ahead with your tax obligations and don’t let these and other penalties hold you back from success!

Author: Rizwan Qadir

Hi there, thanks for checking out my blog. I hope it was helpful and you found the information you were looking for. I post accounting related content. Specifically, I write on accounting software, general bookkeeping, payroll processing, taxes and compliance and related topics. If you have any questions, feel free to shoot me an email at: info@markhambookkeeping.ca or message me directly with your query using the WhatsApp link provided on the website.